When you have a lot of debt hanging over you, doesn’t it feel overwhelming?

How are you going to pay it off?

Will you pay it off… like before you reach retirement age?

Where do you start?

When I had $8,000 in private student loans, I felt like this. You may have more or less than this. And the circumstances of how you accumulated debt may be different.

You may have lost your job and weren’t able to find a new one as quickly. Your new job pays peanuts and doesn’t cover your family’s health insurance.

Or maybe you had a health emergency and your insurance didn’t cover a lot of your bills. Or you don’t have insurance.

You’re living on one income with small children and are barely making it. You’re on disability and can’t return to work.

You used your credit card for every purchase and didn’t have enough to pay it off. The balance and interest grew out of control! It happens to the best of us, even me.

Let’s focus on how you’re going to pay it off, with a clear cut plan.

1. If you have credit card debt, stop using your card(s) and switch to cash.

This is a hard adjustment at first, but force yourself to do this now so you can start moving forward on paying off debt, rather than create more debt.

You’re in debt payoff, crisis mode now. Look for any extra cash like coins and go to Coinstar.

Return any recent purchases that still have tags and are returnable. Trade any unused gift cards for ones that you can use like for groceries.

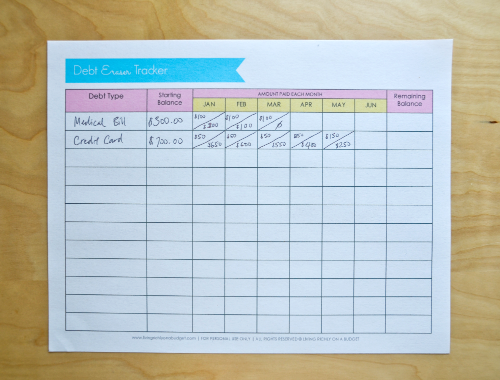

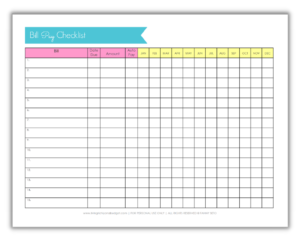

2. Write down all of your debt on a sheet of paper, an Excel sheet, or use my Budget Printables.

For example: Student loan $8,000, Credit Card #1 $5,000, etc.

3. List the interest rates, due dates, and minimum payment amount.

4. Figure out how much money you have in your budget to pay off debt.

Write this number down on your Debt Payoff sheet.

5. Cut expenses.

Can you cut cable, lower your car insurance (with a low mileage discount if you don’t drive that much), sell something, cook more at home, or cancel unnecessary subscriptions?

6. Figure out which debt to pay off first.

Pay more than the minimum amount on this debt to pay it off.

You can focus on the smallest debt amount, called the Debt Snowball Method by Dave Ramsey, to build confidence and momentum. Or you can pay off the one that bothers you the most, like loans from family or friends.

There’s no right or wrong way. Do whatever will make you feel better and will relieve the most stress.

As long as you’re paying off debt, you’re making progress. Any bit of progress is progress and you’re getting somewhere. Each step, each $50 payment, gets you one step closer towards your goal of paying off your debt.

7. Research ways to earn more money, doing side jobs or working overtime.

Put that extra money towards your debt. An extra $20, $50, $100 can really help you reach your goal faster.

And if you get a windfall, like Christmas money or a tax refund, use it to pay down your debt!

8. Get into the debt payoff mindset.

Tell yourself that you will pay off this debt. And if you need a timeline, then figure out how long it will take so you have an end date.

This actually provides some relief as you’ll know that there will be a concrete end date. That you won’t be paying off debt forever.

You might even pay off your debt sooner than this.

9. Get your significant other onto your debt payoff plan.

You can pay off your debt on your own. But if you and your significant other are not on the same page financially, it will be hard to stay debt free.

It may take months or even years for the financial trust to develop. Be patient and gentle. And talk openly while asking for their feedback and input.

10. Celebrate each win.

After you’ve paid off each debt, give yourself a reward, a small treat. I like to celebrate by visiting my favorite food truck. I cook a lot at home so not having to cook is a reward.

You don’t necessarily have to spend money. A reward can include walking on the beach or taking a hike.