Many of us are living month to month, paycheck to paycheck.

Many of us are living month to month, paycheck to paycheck.

And credit card debt is one of the reasons for this.

It’s a burden we carry with us, seemingly for the rest of our lives.

Even though no one else can see it, you feel it, the dark cloud hovering over your head when you wake up in the morning and when you sleep at night.

But it doesn’t have to be that way.

If you simply ignore your credit card statements and just pay the minimum due, you’re not really paying off anything.

If you simply borrow money from a friend or worse, from a predatory lender or payday loan, to pay off your bill, you’re causing more harm than good.

You still owe your friend and if you don’t pay it off, your friendship will be irreparably damaged.

If you borrowed money from payday loan or cash advance company, you’ll owe an obscene amount of interest… even more than your credit card interest! You’ll be digging yourself into a deeper hole.

If you’re desperate for money, don’t call a 1-866 number that you see on TV, that promises to give you quick cash without a credit check or one that doesn’t care about bad credit. Nothing good will come out of that!

Trust me, this happened to us and the interest on this stupid loan was $250/mo! So in essence, we were paying $250 a month and not paying off the principal. It was like throwing $250 down the drain each and every month. Very depressing.

Thankfully, we managed to pay it off and quickly. Want to pay off debt but don’t know how to?

Here’s a 5 step plan on how to get started. Take it one step at a time. Make a plan and one day, you’ll be FREE!

1. Know what you owe.

A lot of people who are drowning in debt, got into this situation because they simply ignored their debt. By being unaware of the exact amount of debt you owe, you think you have more money than you really do. Then you end up continuing to spend more than you make, getting yourself deeper and deeper into debt.

2. Take responsibility for your finances.

Your finances are your responsibility, not your significant other’s or your parents’ (or your adult children’s) or a financial advisor’s.

For couples, it’s common for one person to handle the finances while the other plays dumb. Just because one person seems to have a better knack for finances, doesn’t mean the other person is off the hook. The person handling the finances could be just as clueless as you and could be digging you both deeper into debt.

You won’t know if they are really paying the bills or taking out cash advances for a shopping spree. You won’t know unless you take control of your own finances.

3. Differentiate between a “need” vs. a “want”.

Do you really need a fancy car, designer clothes, or the latest tech gadget? To get to this point, you’ll have to do some soul searching.

If you are secure with who you are, then you won’t need “things” to make yourself feel better. Consumer debt is usually tied to underlying insecurities. Look into practicing positive affirmations to build a better dialogue to yourself, in your head.

4. Create a realistic budget that includes a debt repayment plan.

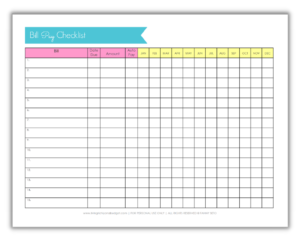

Track your expenses for necessities for a few months on a personal budget worksheet. Make sure you spend less than you make. If your budget still exceeds your income, either find creative ways to save money or earn more money. Be sure to include debt repayment in your budget.

5. Pay more than the minimum amount due.

If you are only paying the minimum amount due, you are only paying the interest for your debt and none of the principal or amount you owe. It’s like running in a hamster wheel and getting nowhere.

Focus on one debt at a time. Pay more than the minimum on one credit card. When that one is paid off, move on to the next.

Pay off your debt as fast as you can, and you’ll start to see the light at the end of the tunnel.