Getting fired or laid off is never a pleasant experience. It is a shocking, sudden change of events that dramatically changes your way of life, state of mind, and financial well being for you and your family.

You were going to work at the same place every day, thinking that everything was ok until now. Take a breath and take a few days to take it all in. But don’t panic.

A lot of people get fired or laid off several times in their lives, no matter how successful they are or how hard they have worked. Don’t take it personally either. I know that sounds hard.

However, in this economy, many businesses aren’t making enough money and have to cut down on costs. As a result, they have to let employees go. That’s part of life.

1. File for unemployment even if you’re not sure you qualify.

As soon as you can, file for unemployment. It’s quicker and easier to do this online. The reason you should do this early on is that it takes at least a month to get your first unemployment check because they have to interview you to see if you qualify.

File for unemployment even if you’re not sure you qualify. Even if you were fired, not laid off, you might still be able to qualify for unemployment.

The unemployment office will call you to determine why you were let go and if you received any warnings. Be truthful.

They will contact your last employer to get their side of the story. In my experience, most employers don’t respond. If they don’t respond within the time period, then the unemployment office takes your side of the story. You have nothing to lose. Let the unemployment office figure out if you qualify.

2. Vent for a few days.

Getting fired is a tremendous loss. Give yourself some time to process it and get it out of your system.

Talk to former co-workers, if you can, since they know your situation or talk to friends and family. Let yourself grieve your former job. Then get over it.

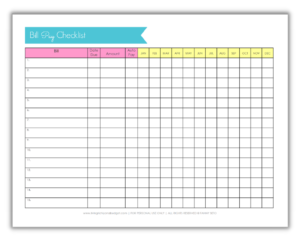

3. Cut out unnecessary expenses.

As soon as you can, cut out things that you can live without – cable, subscriptions, etc. Your goal is to survive for a few months without your regular source of income. Every little bit helps.

4. Sell anything you can.

Are there any big ticket items that can be sold quickly? Electronic gear, musical instruments, photography equipment, etc. Big ticket items will garner more money for less effort. You’re in survival mode so figure out what you can live without.

5. Dip into your savings or figure out how you can stay afloat for the next few months.

Hopefully, you saved up for a time like this. But if you didn’t, think about extra, hidden money that you have. There are countless financial experts who advise against taking out retirement savings.

Let’s face it, if you can’t make rent for the next month or pay for health insurance, you have to do what you have to do to survive. If you do an early withdrawal from your retirement, be aware of the 10% penalty, taxes, and other consequences. Consult a tax professional first.

Also, the unemployment office may see this as income. Consequently, you may not receive your full unemployment benefits during the week of your withdrawal.

Otherwise, can you move in with family… or friends?

6. Update your resume.

Next, update your resume and your skills. List accomplishments rather than merely skills.

Did you help your company make a large sale? Did you implement a process that saved your company X amount of money?

Achievements will make you stand out from the hundreds of other applicants.

7. Apply for jobs, even ones that you are overqualified for.

It goes without saying that you should start applying for jobs as soon as you can – craigslist.org, Monster.com, Indeed.com, etc. Apply for jobs that you qualify for and ones that you are overqualified for.

The truth is that there are hundreds of applicants that meet the minimum requirements. Companies would rather hire someone who has 5 years of experience vs. someone who has 1 or 2 years of experience, even though the job description says they want 1 or 2 years of experience.

And go on every interview, even if it is a lower level job and pays less. You never know where that can lead.

8. Let everyone know that you’re looking for a job.

This is by far the most effective way to find job leads. You know how they say “it’s all about who you know”? Well, they’re right!

Human resources departments have to weed out hundreds of applicants. How can you compete? An internal referral will always get further consideration.

Let everyone know that you’re looking for a job through a phone call, email, LinkedIn, Facebook, etc.

9. Stay positive.

No matter how dire your circumstances are, stay positive. How do you do that when the future looks so bleak?

Start by being thankful for what you have – your health, your family, friends who love you, food on the table, a place to live, some free time.

Relax a little and take this time to reconnect with old friends. It will go a long way towards getting you back on track emotionally.

Hang in there. Stay positive and things will get better!

* Follow me on Facebook for updates and exclusive content!