I remember getting my first credit card in college, a card I still have today. They had a booth right in front of the student union and gave away free T-shirts. Ironically, I never got a free T-shirt.

I felt a new sense of responsibility, like I was entering adulthood. I had the power to buy anything, well, within my credit limit at least.

I always paid it in full and it helped me get started building my credit history. And because I still have the card now, it shows responsibility over time.

Now that I am a parent, I worry about my daughter. I hope that she will grow up to be responsible with her money. And when she grows up, this is the advice I will give her about her first credit card.

Reasons to get your first credit card. You need it to:

- Rent a car

- Buy a plane ticket

- Make hotel reservation

- Shop online

- Build a credit history

When you pay in full each month, you’re building a good credit history for the future. And with good credit, many doors will open.

With a good credit history, you can:

- Rent an apartment

- Score a lower interest rate on loans

- Secure a lower rate on your car insurance

- Qualify for better credit cards, some with the best credit card rewards.

What NOT to do with your first credit card:

- Spend more than your credit limit.

- Carry a balance each month.

- Use your card when you carry a balance from a previous month. You will accrue interest the day you make a purchase.

- Pay late or forget to pay.

Pitfalls of having a credit card.

You can be tempted to spend more than you make. It’s easy to spend money with a credit card. You just swipe it and sign a slip. You can’t really see the total amount you are spending per month unless you track it with a free handy tool like Mint.

You can get addicted to having credit cards that you open several cards and you lose control of your spending. Then you will fall into credit card debt.

The truth is many people are in credit card debt. It is depressing, overwhelming, and holds you back from building a solid financial future. Once you are in debt, it may take many years to get out of debt.

Questions to ask yourself before getting your first credit card:

1. Do you earn an income independently?

That means, do you have a job? Money from your parents doesn’t count as independent income. You must make money before you can spend it. It feels good to buy things using the money that you’ve worked hard for. You will have a different perspective of money when you earn it yourself.

2. Do you know how to budget?

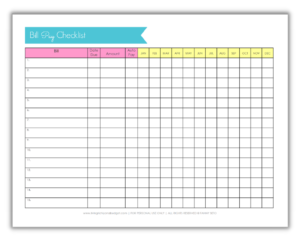

Budgeting, in a nutshell, is choosing how to spend your money before you spend it, so that you won’t spend more than you make. To get started on budgeting, check out these personal budget worksheets.

It starts with knowing how much you make so that you will know how much you can spend. It will help you to know how to budget before you apply for a credit card.

3. Do you have a healthy relationship with money?

Let’s use the analogy of someone who is overeats. Some people overeat because they feel bad about themselves. Similarly, some people overspend because they feel bad about themselves.

Do you spend money to impress others? Do you spend money on things you don’t need so that you can feel good about yourself? If this is an issue for you, you may not even notice it at first. You may be overspending and not even realizing it.

Being emotionally healthy is very important because it will affect the quality of your life. Money will never truly make you happy if you aren’t already happy with yourself.

If you don’t believe me, check out the stories of people who have won the lottery only to lose it all. Some of them end up in a worse situation than before they won the lottery.

Work on this issue with a professional before you get a credit card. Otherwise, you will find yourself in debt and it will be ten times worse. I know people who have been there and it’s not a fun place to be.

If you are ready to handle the responsibility that comes with having a credit card, then see where you can apply. You may want to start small with a store credit card or a low balance student credit card, to see how much you can handle.

Where to apply:

- See what student credit cards are available on your college campus.

- Check out what your bank offers.

- Open a store credit card.