Planning for a budget is one thing. The hard part is to stay on budget, and make sure you stay within your spending zone.

The spending zone, is a term I use to describe what you are willing to pay for either an object, a grocery shopping experience, or even how much money you are going to spend in a week. For example, “I am only going to spend $50 on a BBQ grill, and not a penny more.”

Sticking to a budget is habitual, the more routine you make it, the better results you are going to see. Here is a list of five ways to make following a budget easier.

1. Never Pay Retail Price.

Although this may seem, almost impossible, it is a very suitable option. Your average retail markup is 30%, so what that really means, is that you are paying 30% more than you have to.

This retail mark up is based on a simple supply and demand model. Once a product has more supply than demand, and fixed costs of manufacturer are met, that product will be sold for manufacturer price, or less.

For example, if a manufacturer sells 90% (90 units) of product A to a department store for 10$ an item they make 900 dollars. If you estimate a 5$ fixed cost, mixed with a 2$ overhead they have $630 in expenses. Therefore a profit of $270.

However, for those last 10 units, simple economics will tell you to sell them as long as you are getting back your fixed costs. In that case the remaining units would be sold at $5 a unit, and a profit is still being made overall. This is when you see sales at stores, or find yourself able to buy the same product at a TJ-Max for half the price. If you have patience, you will never have to pay retail price.

2. Purchase Large Quantities.

If you want to stay on budget and within your spending zone, shopping for larger quantities is a great way to do this. Many people do not wish to shop for large quantities due to inconvenience, or lack of storage. On top of that, some things are just not suitable to buy in large quantities.

However, things like toilet paper, paper towels, toothpaste, soda, freezer foods, are the simplest ways to save money. The savings are endless.

One thing that will be more convenient when shopping for large quantities, is the amount of trips you will to take to grocery stores. Shopping for larger quantities may save you 4-5 trips to the local grocery store.

If you shop in advance, planning two weeks ahead, it is easier to stay on budget and within your spending zone, and save yourself trips to the grocery store every other night after work.

For instance, if you buy a coke every morning for $1.20 you are spending $16.80 after two weeks. If you shop at a Sam’s Club, or a Costco you can get a 30pack of coke cans for around $12. You will end up paying less, for double the product, as well as save trips to the convenience store every day.

3. Buy Last Years Model.

This isn’t always the most appealing option for people, but if you can’t get this years model without all the markup, it is the next best solution. One thing to remember, companies produce products for one purpose, and that is to make money.

With that being said, they have to come out with a new product every year to keep sales high. Usually the “new” product companies come out with, is hardly differently from the previous years model. Every new model is substantially more money from last years model.

EA Sports, a company that produces video games, is even being sued for creating a monopoly in the video game world. They sold virtually the same game year after year, with minor changes, for a extremely high price (around $60 a game).

The video game from the previous year would drop down from anywhere to 8-12 dollars a unit. Think of it this way, when you drive that brand new car off the lot, you lose up to 40% of your value instantly. Whats wrong with buying the used car with 12k miles on it, and paying 40% less?

When buying the newest model, what you are really paying for is the companies new advertising scheme to attract even more customers.

Of course you might be missing out on the newest feature, but is that feature really worth 40% more? one thing to consider as well, your brand new item is going to be worth as much as the old one in about 4 months.

- Does Your Budget Spark Joy?

- Free Practical Guide to Your First Budget

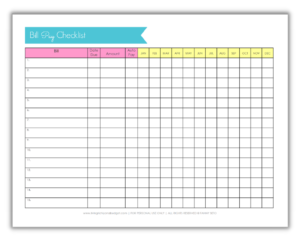

- Organize Your Bills Like a Boss with a Bill Pay Checklist

- 5 Secret Money Management Tips for Couples

4. DO NOT Eat Out.

When I say do not eat out, I mean, do not eat out often. In fact, it is good to reward yourself for sticking to your budget once a week by enjoying a night of dining out.

If you are staying within all of your spending zones, you won’t have anything to worry about picking up the check once a week, guilt free. This will actually help you to stick to your budget even more so knowing that you have saved “x” amount of dollars throughout the week.

The problem with eating out is when it becomes an everyday occurrence. I am including eating out for lunch every day at work. If you pack a lunch, you can save anywhere between 50-100 dollars every week. Not to mention all the calories you will be saving packing fresh foods.

Then, dining out once a week with the family will be more rewarding, and might even turn into a little family tradition you grow to love.

5. Have a Budget Buddy.

A budget buddy should be someone close, like a family member, spouse, or even a close friend. A budget buddy should be someone you share your financial information with.

Although this may seem scary, this will help you in so many ways. You will second guess spending extra money on those useless impulse items, feel more in control of your finances, and even grow a stronger bond with someone in the process.

It is very important that you trust your budget buddy. This should be someone who is a responsible caring individual.

Don’t be afraid to ask for help, and don’t be afraid to admit you made mistakes. Everyone has made financial mistakes at one point, the first step to fixing them is correcting those mistakes, not just simply ignoring them.

Everyone’s budget is different. Therefore, you must plan accordingly. If you set up spending zones for everything you are buying, and then stay within those limits you will be doing great financially. Debt will slowly disappear, and your stress levels will be relieved as well.

Executing your budget isn’t always the easiest thing to do, but it certainly does pay off.

Want to create a budget? Check out my budgeting binder, Budgeting Made Easy.

This article was written by Alyssa Jacobs.