Budgeting 101, it’s important to live on a budget and not overspend these days. The best way to do this is to use a printable budget worksheet that you refer to every month.

What’s the advantage of a printable budget worksheet vs. an online app?

You won’t get distracted with the things that come along with going online like social media, videos. etc.

Seriously, if you want to stay focused, going low-tech with a pen and paper is the way to go!

The goal is to spend less than you make. And hopefully, you have a little leftover for savings and other financial goals.

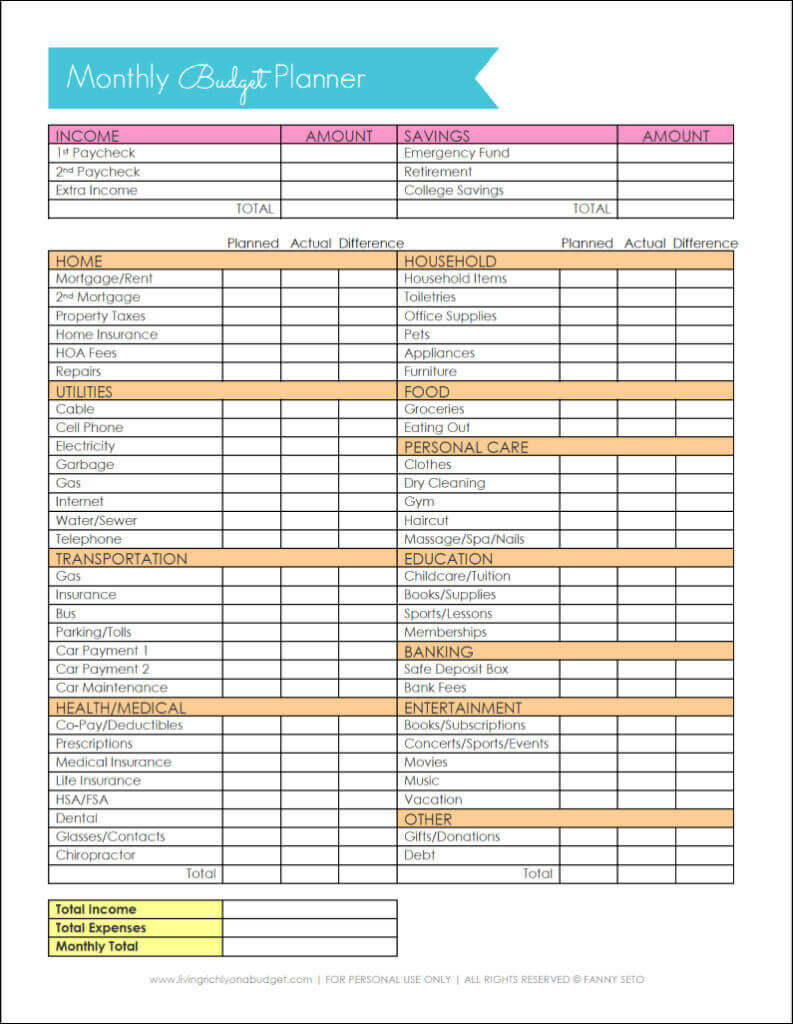

The key is to know how much you make, how much you spend, and how much you owe. Recording this info onto a budget worksheet gives you a good picture of your financial position.

Once you have a budget worksheet filled out, you can refer to it month to month to see where to make adjustments, if needed.

A budget worksheet isn’t set in stone. Chances are, you’ll be like most people who will have to make changes to their budget.

Click here to get my Printable Budget Worksheet and Budgeting Guide.

How to Fill Out a Budget Worksheet

As your life changes – you go to college, move out on your own, get married, have kids, retire, so will your budget.

If there’s an expense item that doesn’t pertain to you, then skip it.

Sources of Income

Let’s explore the things that will go into your budget worksheet, starting with income. Think of all the ways you earn money.

Pay Periods

With paychecks, everyone gets paid differently. Whether it’s weekly, bi-weekly, twice a month, or monthly, keep this in mind when you enter your income.

With bi-weekly pay periods, your paycheck amount will be different for each month so you can calculate your annual salary (after taxes), and divide by 12. I know it’s not perfect but do what works for you.

Self-Employment/Freelance Work

I know it can be challenging to figure out how much you make when it varies month-to-month. Generally, you can predict how much you make by looking at last year’s income.

If your income spikes certain months, then it’s better to allot of a more conservative number. So put in your average month because you probably make at least a certain amount per month, right? Go with the lower number.

- Salary

- Bonus

- Commissions

- Sales

- Freelance Work

- Blogging Income

- Child Support

- Rental Property Income

- Interest Income

- Social Security

- Pension

- eBay income

Pre-Tax Budget Categories

Generally, pre-tax items are already deducted from your paycheck. so don’t include them if your company has deducted them.

- Retirement plan contributions (eg. 401K)

- Health insurance premiums (Medical, Dental, Vision)

- Contributions to HSA or FSA

- Employee stock purchase plan

- Union dues and other job-related expenses

- Child support

- Disability Insurance

Savings

This is fairly straighforward. Add in the amount you are saving.

- Savings Account

- College Savings

- Retirement Account (NonEmployer Sponsored)

Housing

- Rent or Mortgage Payment

- Home or Renter’s Insurance

- Property Taxes

- HOA fee

- Home Repairs

- Household Items

- Furniture

- Housecleaning Service

Utilities

- Electricity

- Water

- Garbage

- Gas (for heat and cooking)

- Internet

- Landline Phone

- Cell Phone

- Cable (this can go under Entertainment instead)

Debt Payments

- Credit Card Payments

- Student Loans

- Other Loans

Food

- Groceries

- Eating Out

- Coffee

- Food Delivery Service

- Kid’s Lunch Money

- Bar

Transportation

- Car Payment

- Car Insurance

- Gas

- Smog Check, License Renewal, and Taxes

- Car Maintenance

- Parking

- Toll

- Public Transportation

Personal Care

- Clothing

- Salon or Barber Shop

- Toiletries

- Laundromat/Dry Cleaning

- Gym

- Massage

- Doctor and Dentist Visits (or include in your Health Savings Account budget, if applicable)

- Prescriptions (or include in your HSA or FSA budget, if applicable)

Family

- Childcare/Babysitting

- Baby Supplies – Diapers, Formula, Wipes

- Lessons/Activities

- Allowance

- School Expenses

Education

- Tuition

- Books

- Fees

- Supplies

Entertainment

- Movie Tickets

- Concerts

- Music Purchases

- Video Games

- Pay-Per-View

- Hulu/Netflix/Redbox

Miscellaneous

- Tithe

- Gifts

- Charity

- Pet Supplies and Vet Expenses

- Free Spending Money or Personal Allowance

- Contingency Amount

You may have to adjust your budget every month until you can find out how much you really need to allocate in each category. Spending changes month to month so don’t be afraid to make changes.

- Budget Binder Tutorial

- Free Practical Guide to Your First Budget

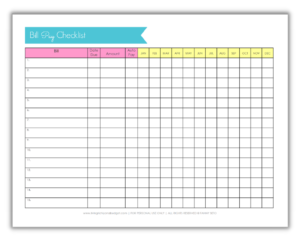

- Organize Your Bills Like a Boss with a Bill Pay Checklist

- 5 Secret Money Management Tips for Couples

Movie production budgets typically set aside a contingency amount of 20%. It’s not a bad idea to leave yourself a little extra for those unexpected purchases you’ll run into. It doesn’t have to be 20% but figure out what works best for you.

For items that you don’t pay for every month, such as car insurance, divide the total cost per year by 12. This will give you a monthly cost to add to your budget worksheet.

Check out my new digital budget planner, Budgeting Made Easy Digital.

Want even more tips on creating a budget? Check out my new ebook with printable budget worksheets, Budgeting Made Easy.

This is a well-written article on strategic budging. Although, pay yourself first is the first step to saving. I also suggest that the key component to everyone’s retirement plan should include life insurance.

Great tips for the basics of setting a budget!