Credit cards that offer rewards have powerful incentives to use them irresponsibly. Rewards can take the form of points, redeemable for certain goods or cash offered in return for purchases.

For example, major credit card companies like Chase offer anywhere from .5% to 2% return on cash purchases. A credit card user who made a $1,000 purchase would therefore receive $20 at 2%. Small amounts over time add up to large sums.

Here are 3 ways to maximize the cash from this program.

1. Use the Cash Back Card to Purchase Everything

The easiest way is to simply use only the card with cash back for everyday spending. Groceries, clothing, pet food and any other miscellaneous spending should go on this card. Going overboard and spending an extra $1,000 each month to take advantage of this reward is counterproductive. First, paying off the balance at the end of the month will be much harder. Second, most credit cards have a yearly limit on how much cash back a customer can earn. Spending a large sum of money each month won’t work if it exceeds the yearly limit in a few months.

Credit cards with a higher introductory cash back rate are even better. Plan major purchases in advance and time them to fall within this period before the rate goes down to normal levels. This will result in more money than would be the case otherwise. Combined with the extra cash back from making this credit card the currency of all regular expenditures results in literally free cash at the end of the year.

2. Pay Off the Balance in Full Each Month

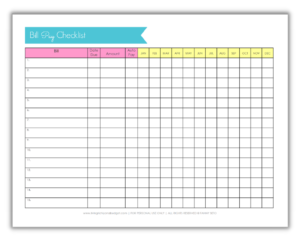

To keep the advantage of cash back, it is critical to pay off the outstanding balance each month in full. Cash back credit cards tend to have higher interest rates than regular credit cards. Rolling over an outstanding balance from month to month activates the higher rates and wipes out any benefit from cash back. Keep careful track of all purchases made during the month and save enough money to pay off the balance at the end of the month.

Saving enough money to do so is paramount to this part of the process. Open a high-yield savings account and keep the money to pay off the balance in it. Then, set up an automatic debit from the savings account to the credit card account on the due date. The money will be automatically transferred. Ask the bank for the correct account forms to start this account.

3. Get a Joint Cash Back Card

Apply for a joint cash back credit card to maximize the rewards even further. A joint account translates into higher balances and higher cash back earned each month. There is a major downside to this arrangement however. The credit histories of the two account parties will be linked together. Any problems with the card will show up on both accounts. Both people who sign up for this account need to be aware of the responsibility both share for the card.

To get the most out of this card, consider that most joint cash back cards also offer a high introductory rate. Consider a card that offers 5% for the first three months and 1.5% for the following months. When the joint account balance has been used to maximize the cash back benefits, apply for another joint card. This will allow both parties to enjoy six months at the 5% cash back rate. After the six months is used up, pay off and cancel one or both of the cards.

Dave works at Credit Card Compare, an independent website where Australians can compare cashback credit cards and find the best deals.