I came across this funny and inspirational video about how to be happy. And no, it doesn’t come from winning the lottery.

It’s about changing your mindset and outlook on life. No matter what your circumstances are, you can be happy.

It’s all a matter of whether or not you choose to look at the positives or dwell on the negatives. Do you tell yourself that you will get out of debt and have a more stable financial future or do you sulk and tell yourself that you’ll never pay off debt or get anywhere in life?

What you tell yourself in your head is really important. People who are successful in life think positively. They told themselves that they would reach their goals and they did.

How did we pay off over $10,000 in debt when my husband and I were living on one income and I was in and out of jobs from layoffs? It started with changing our mindset that we were going to pay it off.

Don’t borrow money.

In the beginning, out of pure desperation, I wanted to borrow money to get out of this hole. I felt like we were on a sinking ship and I wished so badly that someone would bail us out.

Believe that you can pay it off.

My dad gave me a pep talk on how I could pay it off. And that was the boost that I needed to go for it.

Learn all you can about personal finance and budgeting.

So I read all the books I could find on personal finance at the library. And I would repeat Suze Orman’s mantra “I have more money than I will ever need”, whenever I felt like we didn’t have enough money that month.

Get your significant other on the same page.

My husband and I had lots of talks about our finances and we decided that we had to be on the same page. This is probably the hardest part about paying off debt, getting your significant other to work with you, not against you.

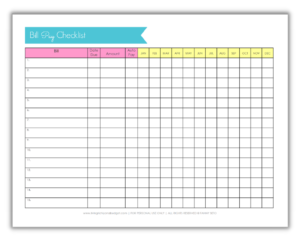

Start a debt payment plan on Excel or paper.

Then I started an Excel sheet of all the debts we had, the interest rates, minimum amounts due, and due dates. Every month, I would look at this sheet and decide which debt to “attack”.

Pay off the smallest debt first and celebrate small victories.

I heard about Dave Ramsey’s Snowball Method of paying off the lowest debt first, instead of the one with the highest interest rate.

And paying off the smallest credit card debt and not having to think about it ever again, felt like a huge burden lifted off my shoulders! It freed up more money to apply to another debt. And it felt good to cross that debt off the Excel sheet and not have to think about paying it the next month or ever again.

Use windfalls to pay off debt faster.

When we had a windfall, we would pay off more of the debts. One by one, we paid off each debt until all of it was gone!

And we’re going to have to start paying off debt again, medical bills. It seems insurmountable again. But I will start the same process of a debt Excel sheet again. And pay off these debts. We did it once and we will do it again.

Need inspiration?

Here is an uplifting video by Shawn Achor, author of The Happiness Advantage, a book I want to read. He is speaking at the exclusive TED conference on how to be happy.

It’s worth watching because he’s not only entertaining but he drives his point through, on how you can change your life around and be happy. If you need a motivator, this is it!

Photo Credit: Jessica.Tam