We are experiencing an unexpected financial crisis and tough economic times, as prices of things have risen quickly and dramatically. Almost every major company has had layoffs in the past 3 years.

In California, minimum wage for fast food workers will rise to $20/hr, which means the cost of fast food will go up accordingly.

The cost of eating out in general has gone up. When we go out for a meal in the San Francisco Bay Area, entrees that were once $9-$10 are now $15-$20!

On top of that, incomes have not risen to match inflation and rising prices. So what are families who are struggling supposed to do? Families are already trying to survive with credit card debt, rising rent prices, sky high gas prices, and soaring food prices.

15 Tips for Surviving Inflation

1. Track your budget.

Sometimes budgeting has a negative connotation because many people associate it with being restrictive and limiting. But think of it as a way of taking care of your money.

If you don’t take care of your money, how will it take care of you? If you didn’t take care of your car, how do you expect it to run well when you need to go somewhere?

When you earn it, track it, save it, and carefully spend it, it’s like you’re filling it up with gas, washing it, maintaining it, and driving it. If you need help with starting a budget, check out my comprehensive ebook guide – Budgeting Made Easy.

2. Run errands all at once.

Even though gas prices have dropped a little, it’s still over $5/gallon here in California. Plan all your grocery shopping and errands together so you don’t have to make multiple trips.

3. Carpool or take public transportation.

Here’s another obvious way to save gas, carpool or take public transportation. Everyone’s situation is different, so don’t feel guilty if you do have to drive on your own. But if there’s an option to carpool or take the bus, then consider whether or not this will work for you.

4. Downsize or houseshare.

I’ve seen so many people downsize after their kids grow up and leave the nest. It makes me wonder whether or not we really need that big house!

I housesat for my brother’s big house. I loved it at first because it was spacious. But after living in it for 5 days, I realized how much work it was to maintain!

A small home is not always a bad thing. Kids only live there for about 18 years and then some move away!

There are pros and cons to housesharing as well but that living situation isn’t forever. A lot of families in our area, houseshare, in order to afford to stay here because the schools are good. Many of our friends have moved 2 hours or more away or even out of state, in order to afford to buy a house!

5. Eat out less and cook more at home.

I have learned to cook SO many things in the past 10 years that we eat at home most of the time. And cooking at home can mean something as simple as warming up frozen pizza or corn dogs. It doesn’t have to mean a fancy 5 course meal!

I cook a lot of simple meals because I just don’t have the energy or time. I don’t make things that require a lot of prep or planning.

Sometimes, when I don’t feel like cooking, I will make a simple charcuterie board with cheese, crackers, and fruit. The kids LOVE it!

If you need ideas for easy recipes, check out my Instant Pot Recipes, Air Fryer Recipes, and Recipes.

6. Make your favorite drinks at home.

I’ve kinda mastered making all of my favorite drinks at home so that I don’t have to step inside a coffeeshop or boba shop. I’ve been doing this even when I was working in an office. I would make decadent (not instant) hot chocolate at my desk.

Here are some recipes to try:

- How to Make Boba Milk Tea Like a Boba Shop

- Thai Iced Tea Without Artificial Food Coloring or Dye

- Gourmet Hot Chocolate

- Make Mocha at Home without a Machine

- Matcha Green Tea Latte

- How to Make Sugar-Free Chai Latte

7. Avoid the mall.

I don’t know what it is about the mall, but every time I step foot inside one with my family, we end up spending $70 or more, unplanned! We might go in for something at Target and walk out with toys, food court meals, and boba drinks.

I’m not saying you shouldn’t spend money but in a mall, it often leads to unplanned purchases that can quickly add up. By the time we leave, we didn’t even realize what happened! Has this happened to you too?

My husband and I have talked about it. We don’t make it a habit to casually stroll into the mall anymore, or if we do go, we plan our spending ahead of time.

I KNOW this is super hard to do in real life, especially with a family! It’s hard to say NO to your kids when they want to buy toys or special treats.

For Target, I try to go without my kids and do the store pickup. And occasionally, I will treat my kids after a tough dental appointment or if they got good grades, but I will give them a budget. You can get anything under $10 or $25.

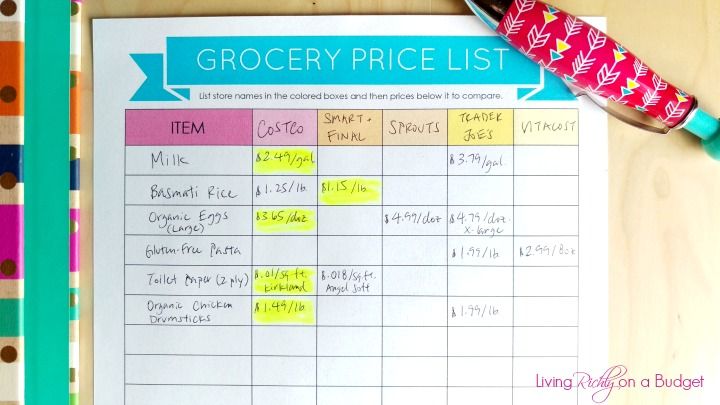

8. Compare prices with a Grocery Price List.

If you have time, then compare prices for the things you buy the most. You can use a Grocery Price List, like the one pictured below. Here’s a guide on how to use a Grocery Price List.

Check out Meal Planning Made Easy to buy my printable meal planning binder, that includes this Grocery Price List.

9. Turn off the news.

News can be addicting but a lot of it is negative news. And the negative news creates fear and can cause depression. There’s also unnecessary social pressure and stress from it, at times.

It’s hard to break this habit of checking the news a few times a day. But I don’t want to live and breathe by what is being reported or written about because it can skew my reality.

I’ve studied TV news in college. And what happens is that the news director decides what stories make the news. They don’t report on everything that’s happening.

They may choose the most salacious and shocking news to get more viewers or views. And if an incident happens and gets a lot of attention, if another similar incident happens, then you bet, they will make a story on it.

But then since we, as viewers, keep hearing about it, we think it’s happening ALL THE TIME. I know of many older, retired people, who, all they do is watch or read the news. All they talk about is the violence and bad things that are happening in the world!

10. Cancel underused subscriptions.

Are there subscriptions you don’t use and can easily cut? Nowadays, there are so many streaming services and subscriptions to things, have you look at whether or not they are worth keeping?

11. Buy secondhand – clothes, toys, etc.

I buy secondhand clothes because if I don’t want it anymore later or my size changed, I don’t feel bad about giving it away. By buying secondhand, I am lowering the attachment level to things.

If we got a toy and didn’t pay that much for it, it’s easier to let go of later. Kids go through toys so quickly, right?

12. Join Facebook free or Buy Nothing groups.

I love these groups as it’s so easy to get rid of things. But you can also find things for free and you are helping the other person as well by taking the thing off their hands. It’s a win-win situation.

I’ve gotten a scooter, elliptical machine, toys, clothes, books, and more. I have had to limit my time looking at these groups because I am trying to declutter and not take in anymore stuff!

13. Take care of your mental health.

This is super important! When you learn how to express and feel your emotions in healthy ways, you won’t have to resort to unhealthy habits, like drinking alcohol, overeating, or stress spending in order to deal with life.

These unhealthy habits can cause other problems as well. Consider seeking therapy or talking to a friend as the first step.

14. Look for grocery sales.

Our local grocery store has been having incredible sales in order to get people in the door. In the past 2 weeks, they had buy one get one free chicken thighs! Wow! And their $5 Friday specials are so popular that it makes Friday their busiest day.

Choose 1 or 2 grocery stores to follow for the sales. No need to go crazy. But only buy things you know you will use.

15. Spend time at the library.

If you ever want to go somewhere where you are NOT expected to spend any money, check out the library! There’s just a freedom I feel when I am there. I can choose any book or DVD and take it home.

I don’t have to say NO to my kids there. They can look at and borrow as many books as they want.

Our library even has 3D printers that are free to use, lots of fun activities, classes, and super fast WI-Fi!

Pin for Later: