We’re all looking for smart money saving tips without resorting to being an extreme cheapskate who dumpster dives for food.

We want to do more with less and live within our means without having to borrow money.

Saving money takes some adjustment – adjusting to new mind set and living a simpler life.

And it’s a process. Here are 30 money saving tips to help you get started.

GROCERIES AND SHOPPING

1. Pay attention at checkout.

This simple thing can save you money at checkout. I don’t know how many times I’ve caught a mistake by the cashier.

Once, the cashier scanned my coupons as items instead of discounts so I “lost” $6 instead of saving $6! So I rushed back to the store to get it corrected.

Another time, the cashier rang up an item that wasn’t even there! I don’t know if she was scamming me or what but a $5 item showed up on my receipt and I asked her where this item was, she had no answer.

Often, sale prices will not ring up on items. Either the product was mislabeled or the sale price wasn’t updated. So that deal you thought you were getting doesn’t actually turn out to be a good deal when you’re charged regular price for it… that is unless you were paying attention and caught the mistake in time to fix it.

My experience has been that if the price was labeled as a sale price but the sale expired and the store forgot to remove the shelf label, then they will honor the sale price.

2. Know prices.

Sale prices are not always the best deals. I’ve learned this the hard way by comparing prices at different stores.

I’ve compared CVS sale prices to Target regular prices was shocked to learned that my Target had the lower price.

3. Cook at home.

This tip is mentioned often online but it bears repeating. Cook at home and you’ll save money!

How much? On average, it costs $2 – $3 per person when you cook at home. When you eat out, however, it’s $12+ per person plus tax and tip.

4. Make espresso drinks at home.

I know everyone talks about this and usually they’re talking about regular coffee, not espresso drinks. Here are coffeehouse drinks that you can make at home, very easily and at a much lower cost!

5. Buy often used items in bulk.

Items we use a lot are toilet paper, paper towels, garbage bags, diapers and wipes (before my daughter was potty trained) and eggs. I tend to buy these at Costco, which has a consistently good price, rather than trying to find coupons for them.

6. Bring lunch to work more.

Bringing lunch to work will save you $5 – $15/day. Yes, in some places like downtown San Francisco, you can spend upwards of $15 (with tax and tip) for lunch out with a friend in a restaurant!

When I don’t make lunch for my husband, he has to buy lunch and that really cuts into our food budget. The reality is if we have a meeting or event to attend at night, then making lunch doesn’t happen and I let it go.

Be realistic in what you can do. It’s easiest to make a double portion of dinner and plan for leftovers to be used for lunch.

7. Transport your own bottled water.

I know this is not the frugal tip that you may see on other sites, but I’m all for bottled, filtered water. When we moved 45 minutes away from San Francisco, the tap water there was dirty and the chlorine taste was strong. We measured it to have 260+ particles in the water! Yuck!

Even after using a Brita filter, it didn’t remove that much. Fortunately, we found a bottle it yourself water filtration store that filtered the water 4 different ways. Plus, it was $ .60 a gallon. And of course, we measured their water. It had only 1 particle in it!

The bonus was that the water tasted good because they remove the salt. So, depending on where you live, it may be worth it to bottle your own water. It’s only $ .25 – $ .60 a gallon.

8. Compare prices.

Always compare prices when you can. The easiest way to do this is online.

For groceries, try jotting down prices for the items you buy the most often or compare receipts by keeping a grocery price book. I like to compare prices for specialty gluten-free items with the prices from sites like Vitacost and Amazon.

9. Look for coupon codes before buying online.

This is super easy to do. Do a quick search before buying an item and half the time you’ll find a discount code. It’s worth the extra couple of seconds to search.

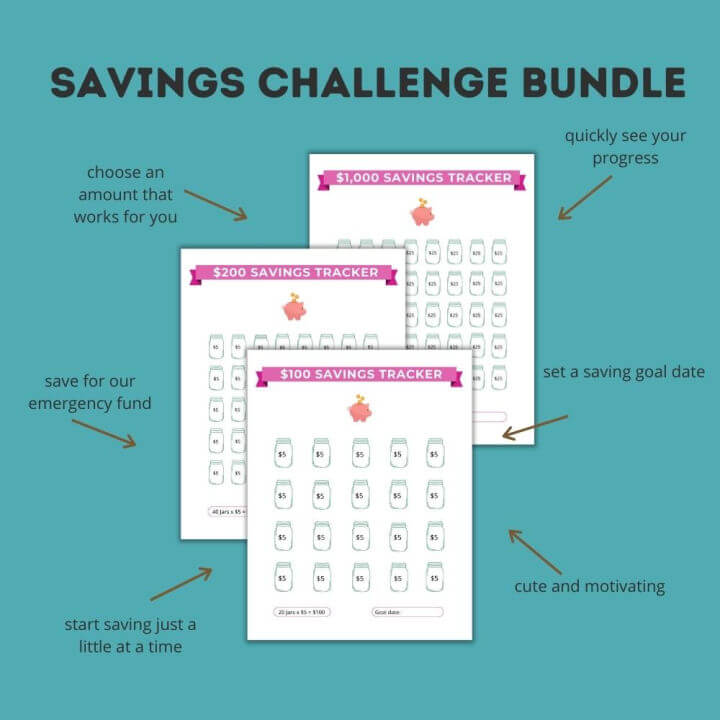

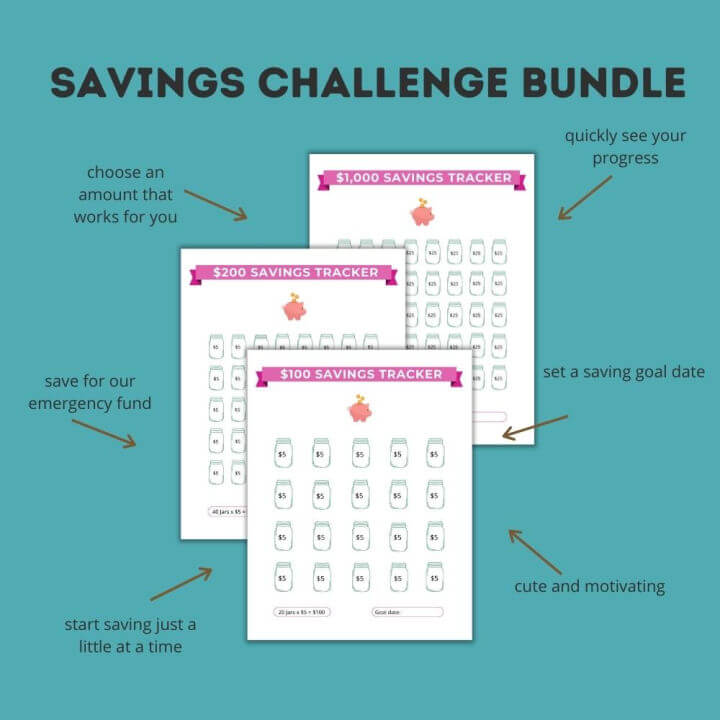

10. Do a Savings Challenge.

Use a printable savings challenge (pictured above) and follow along to save a specific amount, such as $100. In the challenge above, you can save $100 by saving $5 at a time, 20 times. It breaks it down in a very visible way so that you can see your progress and stay motivated.

KIDS AND CLOTHES

11. Buy gently used toys.

Some of my daughter’s favorite toys are from a children’s consignment shop and a consignment sale. My best buy was a Step 2 50’s diner that I bought for just $10 at a rummage sale. It sells for $199+ on Amazon!

12. Encourage hand-me-downs.

If you have a friends with kids who are older than yours, they might be more than happy to declutter baby gear and clothes. This is something where I didn’t ask. Instead, my friends generously offered to give us a their unwanted items like a crib, pack n play, changing table, and clothes. You can let friends know that you’re looking for baby gear on Facebook.

13. Buy clothes second hand.

OMG, I buy a lot of my clothes from ThredUP, an online consignment shop! I’m kinda addicted. Shhh…

I love that they have stylish clothes at a fraction of the cost! And the clothes are in excellent condition. I only spend like $8 – $20 on most items.

What I also love is that if I no longer like an item (because that happens, you know!) it’s easy to get rid of it because I didn’t spend a ton of money on it!

The best way to shop at ThredUP is to:

- Download the ThredUP app.

- Go to Account > My Sizes – choose your size and save it.

- Then Select the category of clothing you want under Women (eg. dresses, tops, pants).

Keep in mind that they have A LOT of clothes to look through. So when I go through stuff, I add things I like to My Favorites, by clicking the heart icon. Then I sort through them later.

When there are sales, I check My Favorites to see if the prices have changed and what’s still available.

You can also find handbag, shoes, designer items, and children’s clothes.

Get a $10 credit to spend at ThredUP on your first purchase!

HOME

14. Fix things yourself.

Repair as many things as you can yourself. With YouTube videos and the Internet, it’s not hard to figure out how to repair things.

My hubby followed a YouTube video to repair his dad’s broken electric car seat, saving his dad hundreds of dollars.

I’ve done simple things like unclog sink drains with a mini-snake and repair clothes with sewing.

However, there are some things that you should call a professional for, like electrical repairs because of the risk of electrical shock or fire if the repair is done wrong.

15. Ditch dryer sheets.

I stopped using dryer sheets when I found out my daughter was allergic to them, even free and clear ones. Since then, we haven’t missed them.

If your clothes are all cotton, they will not cause static cling. Polyester, fleece, and other materials may come out a little staticky but it doesn’t bother us.

You can try using a ball of aluminum foil too.

ENTERTAINMENT

16. Downgrade or get rid of cable.

With so many options to watch TV shows nowadays, you may find that getting rid of cable may not be as difficult as you think. The only thing you’ll miss out on is news, live sports, and awards shows.

When we moved to a new city, we lived without TV for a good year and we lived. We even watched the SuperBowl online. I filled my time with work, spending time with family, and watching Netflix.

Now that we’ve moved back closer to San Francisco, our Internet/cable provider charges the same for Internet and basic cable. So if we remove cable, we’re still paying for it. Obviously, we opted to keep cable.

It’s about what is important to you. If watching sports is a must then by all means, keep cable. But if it doesn’t make a big difference, then cut the cord.

17. Take full advantage of the library.

Our local library has so many fun events for kids and adults. My daughter loves attending the events! We’ve made gingerbread houses, play with robots, learned to make lumpia, and more.

If I want to read a new book, I always check my library first. Most of the time, they have it and I place a hold for it. The most I’ve waited for a popular book was 3 months. Often, the wait time is shorter than that.

I only buy ebooks now or books that aren’t available at the library. It saves so much storage space too!

18. Check out free passes to local attractions from the library.

Free entertainment is always nice. Our local library offers 2 free passes at year to local attractions. A pass usually includes admission for an adult and child.

Some attractions are more popular than others, especially during the summer, so I look months ahead and reserve my passes early.

Our local aquarium costs $30 for adult admission! I finally got my husband to get a library card so that we both can take my daughter and save $60!

19. Socialize at home.

Instead of going out to a restaurant with friends, why not cook for them at home? I find this much easier when you have kids, as it’s hard for kids to sit still in a restaurant. The kids occupy themselves playing toys and the adults get to enjoy kid-free conversations.

We’ve been doing this for the past few years for my birthday. My awesome dad cooks a wonderful feast at home and the kids get to play with their cousins.

20. Watch movies at home.

With Redbox and Netflix, there’s little to reason to go out to the movies anymore. With the higher cost of movie tickets and popcorn, it’s an easy way to spend unnecessarily.

These days, I enjoy watching movies in the relaxed atmosphere of home. My husband and I went to the movies once last year and didn’t enjoy sitting near rowdy teens and the high cost of food.

I don’t feel the need to see the latest film in the theaters anymore. In 2-3 months, it’s already available on Redbox or streaming services.

BILLS

21. Cancel the gym membership, if you don’t go.

We all want to lose weight and stay healthy. A gym membership seems like a good idea, until you realize that you never go.

I had a gym membership for more than 5 years and managed to get a deal where after 3 years, I would only pay a smaller annual membership fee. However, ever since I was pregnant with my daughter, I never went.

3 years passed since she was born and I still never made it to the gym. Even though I would be losing out on the lower cost deal, I finally quit my membership. I ended up saving $200 since.

22. Find a lower cost cell phone plan.

Cell phone companies are super competitive now. Long gone are the contracts. In its place, you pay a monthly fee and can bring in your own phone, pay for a phone in full, or pay a monthly fee to pay off your phone.

There are also options to lease an iPhone, like the iPhone Forever plan through Sprint. It costs less than buying the phone, but you won’t own anything at the end. Also, you should invest in phone insurance if you lease because if you damage the phone during your lease period, you are still on the hook for the full cost of the phone.

Check out pay-as-you-go options if you don’t talk on the phone much. There are so many carriers to choose from like Straight Talk, Cricket Wireless, etc. With these plans, you pay full price for the phone upfront, then pay a monthly fee. If you sign up for autopay, you get a discount on your monthly fee.

23. Monitor your bank accounts and bills regularly.

The beginning of the year was so frustrating for me. My health insurance charged me twice the amount because of a computer error!

With the new health insurance exchange, it was not a simple process to correct mistakes. After several agonizing calls and long wait times on hold, I finally resolved the issue.

Billing errors happen all the time and you’ll only know if you pay attention to your bills and monitor your bank accounts.

24. Score free stuff.

Get free stuff when you can. Check out my list of 25+ Things You Can Get for Free.

25. Collect your loose change.

How much spare change do you have lying around the house or car? You’d be surprised how much those coins add up.

With Coinstar, you no longer have to “roll coins” and turn them into the bank. You can now cash in those coins at Coinstar and use that amount towards your purchase at the grocery store (where the Coinstar is), with a small percentage taken out… or you can choose to get gift card for Amazon and other retailers with no fee taken out.

26. Be creative with what you have.

Do you have to buy something new or can you use what you already have and repurpose it? Get out of the habit of always having to buy things. Sometimes you can get by without it.

27. Learn to be content.

We live in a culture where we’re constantly bombarded by ads – in magazines, Facebook, your phone, TV, movies, billboards, etc. We’re encouraged to consume, consume, consume. And we’re always looking for the next thing to buy.

I noticed this when I used to subscribe to a particular shopping magazine. After I looked through it, I suddenly felt the need to go out and buy new clothes, even though I didn’t need any.

You don’t need stuff to be happy. It’s a lie! And don’t use shopping as an excuse to release stress. Exercise, meditate, or talk to a friend instead!

28. Track your spending.

Tracking your spending may seem tedious, but the beauty of it is to be more aware of your spending. If you use a program to track your spending, it’s easy to ignore.

When you list each transaction, you feel it more and as a result, will spend less because you know where your money is going.

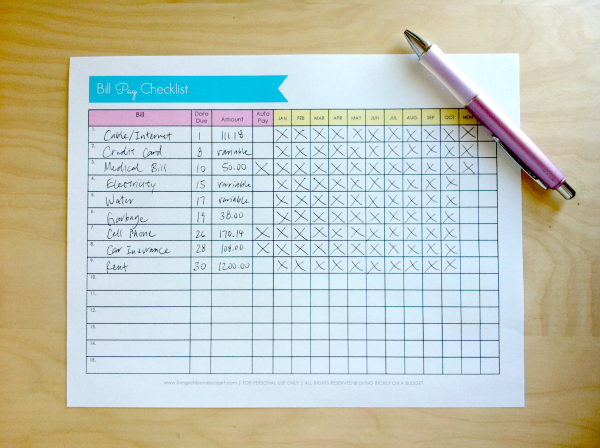

29. Pay your bills on time.

Pay your bills on time and you’ll avoid cruddy late fees. Often that’s easier said than done.

I use a system where I track all of my bills on a bill pay checklist (above). Bills are listed in order of due date of the month.

Each month, I look at my calendar and see which bills are coming up. I make sure that the autopays go through and pay the manual payments, then check off which bills were paid.

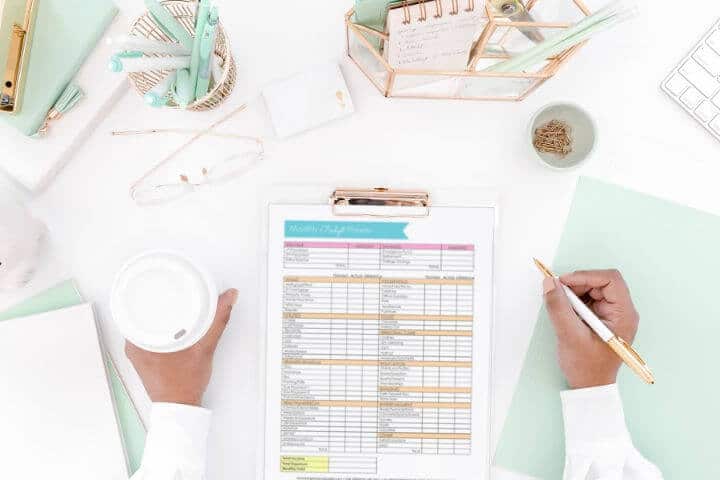

30. Stick to a budget.

Think of a budget as a spending plan rather than something that limits you. Knowing and planning where your money will go will help you feel more in control.

Without it, you’re just spending blindly which means you’re likely overspending and getting deeper into debt. Here are more tips on how to get out of debt.

Want to start a budget? Check out my book Budgeting Made Easy which includes printable bill pay, budget worksheets, expense tracker, and more. Also, check out my new digital budget planner, Budgeting Made Easy Digital for your iPad.

Get motivated to save more money with the Printable Savings Challenge below.

Pin for later:

You might also like:

- The 2022 Budget Binder That Will Transform Your Finances

- The Free Practical Guide to Start Your First Budget

My husband and I haven’t been to a movie in about 8 years now. Besides not having one close to us, little town again, I hate paying the prices for popcorn and drinks! At home I can stop a video, run it back, watch it again, whatever. And many libraries will take suggestions on videos or books to buy, and cd’s. I love our library here for that reason and their liberal loan policy.

We have had to either do our water like you said or buy bottled water the last 7 years. I finally bought a home filter system and jug for the house and just keep gull ones around and rotate them. Good idea to have some in case of problems anyway. we don’t go out as much, and with no family nearby it’s not such a thing. We usually only eat out about once a month.

I’ve been sewing for most of my life, so the only thing we have to replace often is shoes and underclothes. We try to buy the best we can there.

Our biggest expense is medicines for health problems, not much around that so I try to make it up other ways.

Hi Ruth,

Thank you for sharing your saving tips! That’s awesome that you can sew too!

Congratulations on the 2nd pregnancy .. hope things get better as the pregnancy progresses!! Take care of yourself and your family !!

Hi Diana,

Thank you so much for the sweet comment! And thank you so much for being a loyal subscriber! I hope you are doing well too.